这一期主要应用python和R 这2种工具对某真实信贷数据进行分析,通过数据的读取、清洗、探索、模型构建等,比较2种方法在机器学习数据科学上的实现。python实现部分借鉴了KUNAL JAIN 在Analytics Vidhya中的一篇文章《A Complete Tutorial to Learn Data Science with Python from Scratch》(下面有原文链接)。

1 数据科学探索(python 与 R 的比较)

首次尝试使用jupyter notebook来实现python 和 R,感觉在R的部分兼容性方面还是与rmarkdown有些差距。也许是还不熟悉的原因吧。如何在jupyter中跑R 可以查看[Jupyter and conda for R](http://www.tuicool.com/articles/nuaiEnF) 这篇文章.

我们分别从数据科学的主要流程来讨论Python与R 的数据实现。

1.1 数据读取

1.1.1 Python

在python中运用jupyter notebook绘制图形,需要“%matplotlib inline”在代码开头说明。载入相应的库,主要包括numpy、pandas、matplotlib等。python与R一般的操作比较,直接比较代码即可。

%matplotlib inlineimport pandas as pd

import numpy as np

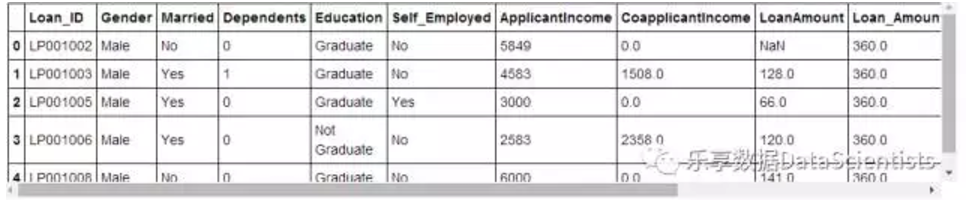

import matplotlib.pyplot as pltdf = pd.read_csv("C:/Users/HP/Desktop/train.csv")df.head()

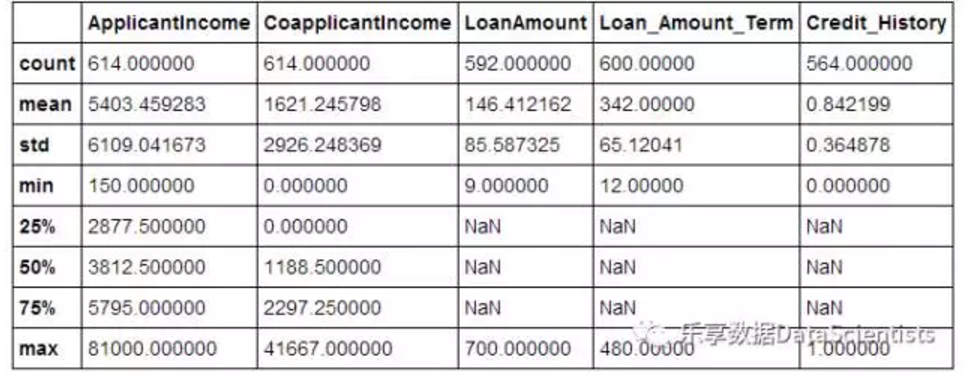

df.describe()

1.1.2 R

在jupyter中跑R,除安装好R的驱动kernel外,下载并加载包,需要先指定mirror(本人版本如此,求高人指点)。运用psych包中的describe函数可获得类似Python效果。

#设置mirror

local({r <- getOption("repos")r["CRAN"] <- "http://mirrors.xmu.edu.cn/CRAN/"options(repos=r)})library(ggplot2)

library(dplyr)

library(psych)

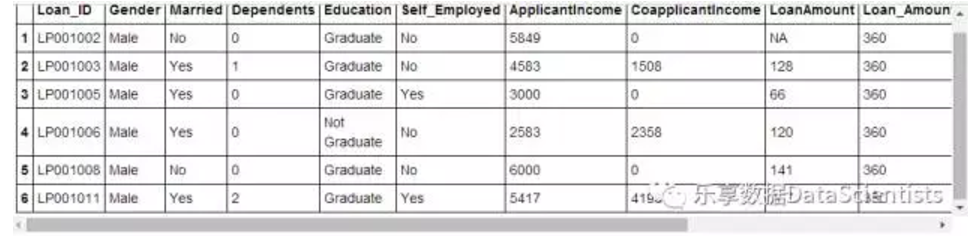

library(Hmisc)train <- read.csv("C:/Users/HP/Desktop/train.csv")head(train)

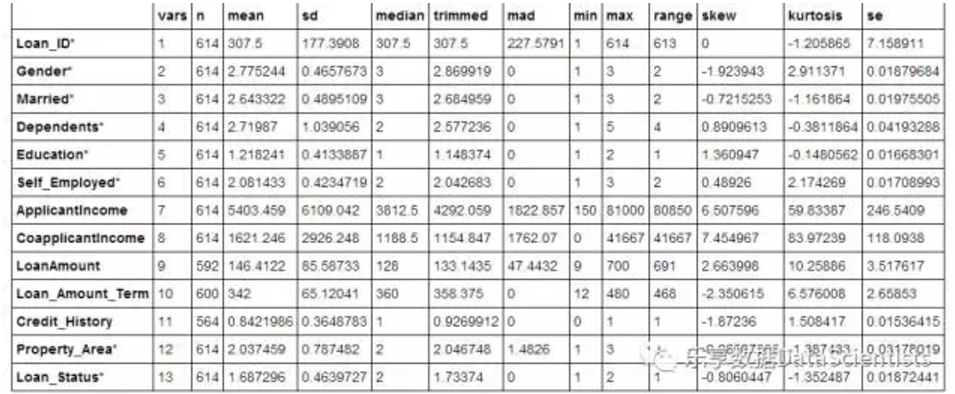

data.frame(psych::describe(train))

1.2数据描述

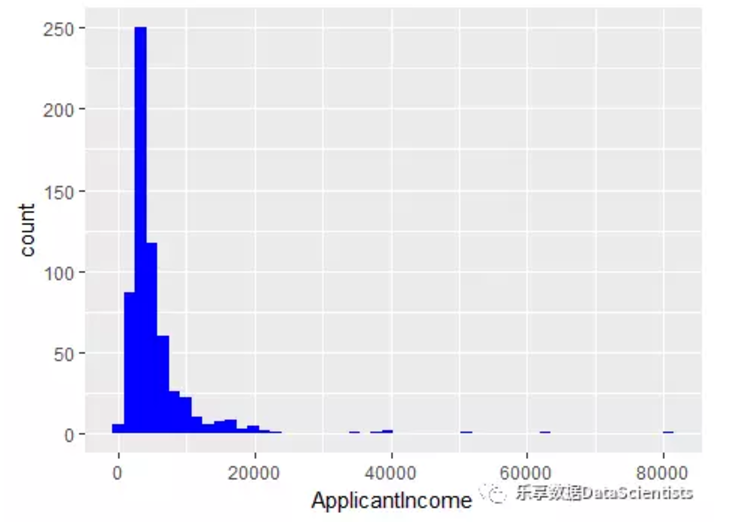

主要包括对计量资料和分类变量的分布进行绘图描述。python主要运用到matplotlib库,R主要运用到ggplot2包。从数据描述及绘图效果来看,python绘制一般图形相对简单,但R运用ggplot图层语法绘图感觉更易理解和操作。

1.2.1 python

#查看申请人地域分布

df['Property_Area'].value_counts()Semiurban 233

Urban 202

Rural 179

Name: Property_Area, dtype: int64#查看申请人收入分布情况

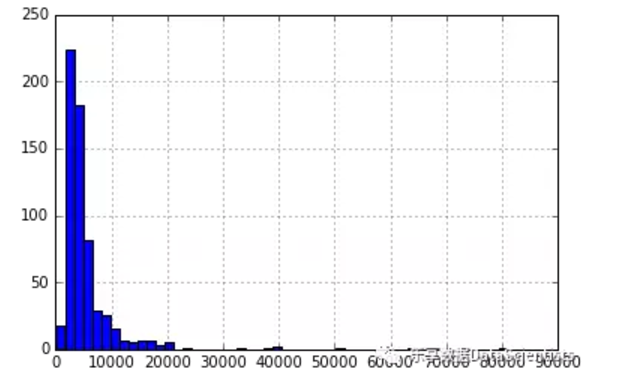

df['ApplicantIncome'].hist(bins=50)

#按教育情况分类,查看收入情况

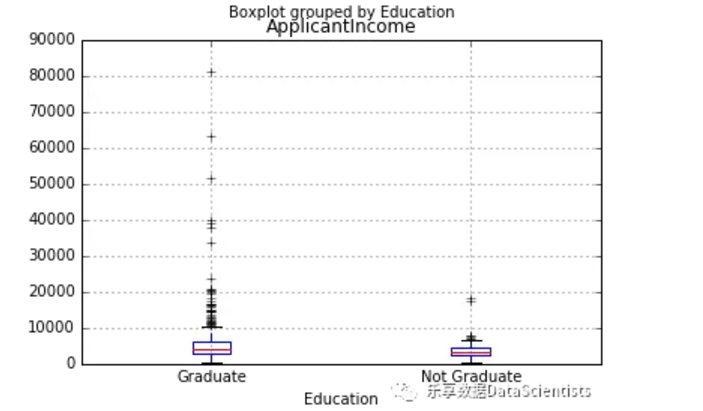

df.boxplot(column='ApplicantIncome', by = 'Education')

#查看申请人信用历史分布并绘图

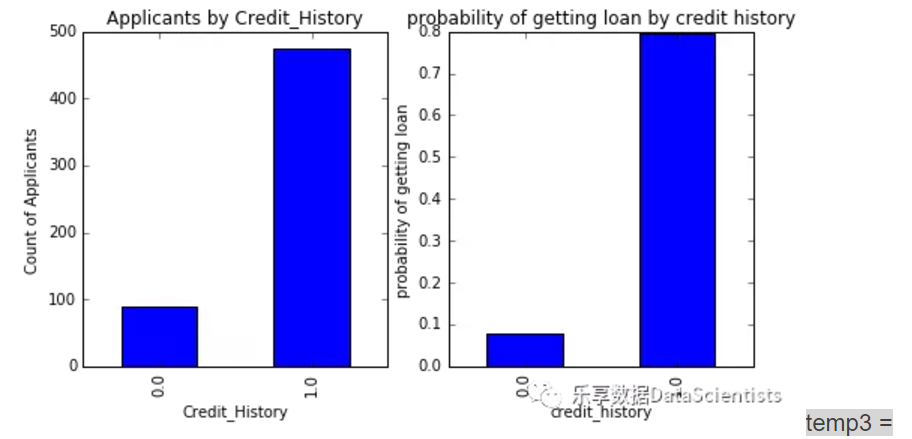

temp1 = df['Credit_History'].value_counts(ascending=True)

temp2 = df.pivot_table(values='Loan_Status', index=['Credit_History'],aggfunc=lambda x: x.map({'Y':1,"N":0}).mean())

print 'Frequency Table for Credit History:'print temp1

print '\nProbility of getting loan for each Credit History class:'print temp2Frequency Table for Credit History:

0.0 89

1.0 475

Name: Credit_History, dtype: int64

Probility of getting loan for each Credit History class:

Credit_History

0.0 0.078652

1.0 0.795789

Name: Loan_Status, dtype: float64import matplotlib.pyplot as plt

fig = plt.figure(figsize=(8,4))

ax1 = fig.add_subplot(121)ax1.set_xlabel('Credit_History')

ax1.set_ylabel('Count of Applicants')

ax1.set_title('Applicants by Credit_History')

temp1.plot(kind= 'bar')

ax2 = fig.add_subplot(122)

temp2.plot(kind = 'bar')

ax2.set_xlabel('credit_history')

ax2.set_ylabel('probability of getting loan')

ax2.set_title('probability of getting loan by credit history')

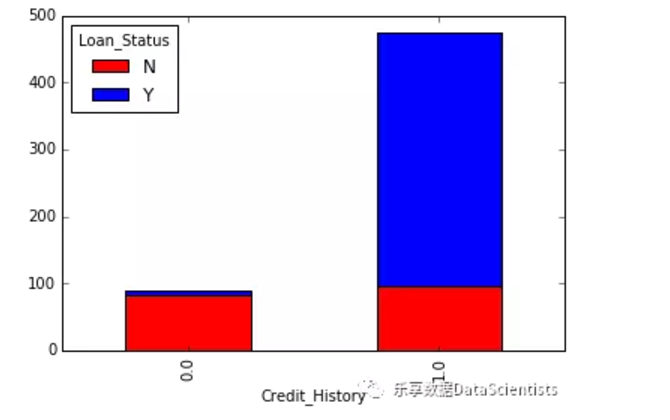

pd.crosstab(df['Credit_History'], df['Loan_Status'])

temp3.plot(kind='bar', stacked=True, color=['red','blue'],grid=False)

1.2.2 R

#申请人地域分布

table(train$Property_Area)Rural Semiurban Urban

179 233 202 #申请人收入分布情况

ggplot(data=train, aes(x=ApplicantIncome)) + geom_histogram(bins = 50, fill = "blue")

ggplot(data=train, aes(x=Education, y=ApplicantIncome)) + geom_boxplot()1.3 数据处理

数据处理主要包括以下方面:

缺失值处理

极值处理

对数据的处理,这里缺失值填补只运用了最简单的平均数或众数替换,数据变换也只进行相对简单的log变换等。感觉R的dplyr包管道操作在数据处理方面比python更胜一筹。

1.3.1 python

# 检测缺失值

df.apply(lambda x: sum(x.isnull()), axis = 0)Loan_ID 0

Gender 13

Married 3

Dependents 15

Education 0

Self_Employed 32

ApplicantIncome 0

CoapplicantIncome 0

LoanAmount 22

Loan_Amount_Term 14

Credit_History 50

Property_Area 0

Loan_Status 0

dtype: int64#计量资料用均值、计数资料用众数填补

df['LoanAmount'].fillna(df['LoanAmount'].mean(),inplace=True)#查看分布

df['Self_Employed'].value_counts()

df['Credit_History'].value_counts()

df['Gender'].value_counts()

df['Loan_Amount_Term'].value_counts()

df['Dependents'].value_counts()

df['Married'].value_counts()Yes 398

No 213

Name: Married, dtype: int64df['Loan_Amount_Term'].fillna(360.0,inplace=True)df['Gender'].fillna(2,inplace=True)df['Credit_History'].fillna(1.0,inplace=True)df['Dependents'].fillna(0,inplace=True)table = df.pivot_table(values='LoanAmount',index='Self_Employed',columns='Education',aggfunc=np.median)print(table)Education Graduate Not Graduate

Self_Employed

NO 126.5 123.0

No 132.0 115.0

Yes 152.0 130.0df['Self_Employed'].fillna('NO',inplace=True)df['Married'].fillna('YES',inplace=True)#最后查看填补结果

df.apply(lambda x: sum(x.isnull()), axis = 0)Loan_ID 0

Gender 0

Married 0

Dependents 0

Education 0

Self_Employed 0

ApplicantIncome 0

CoapplicantIncome 0

LoanAmount 0

Loan_Amount_Term 0

Credit_History 0

Property_Area 0

Loan_Status 0

dtype: int64#数据变换#转换为收入log值

df['LoanAmount_log'] = np.log(df['LoanAmount'])df['LoanAmount_log'].hist(bins=20)df['TotalIncome'] = df['ApplicantIncome'] + df['CoapplicantIncome']

df['TotalIncome_log'] = np.log(df['TotalIncome'])df['LoanAmount_log'].hist(bins=20)1.3.2 R

#查看缺失情况

pMiss <- function(x) {

sum(is.na(x))/length(x)*100 }

apply(train, 2, pMiss) Loan_ID Gender Married Dependents Education

0.000000 0.000000 0.000000 0.000000 0.000000

Self_Employed ApplicantIncome CoapplicantIncome LoanAmount Loan_Amount_Term

0.000000 0.000000 0.000000 3.583062 2.280130 library(Hmisc)

train$LoanAmount <- Hmisc::impute(train$LoanAmount, mean)train$Loan_Amount_Term <- impute(train$Loan_Amount_Term, 360.0)

train$Credit_History <- impute(train$Credit_History, 1.0)

train$Self_Employed <- impute(train$Self_Employed, "NO")

train$Married <- impute(train$Married, "YES")

train$Gender <- impute(train$Gender, 2)#数据变换#转换为收入log值

library(dplyr)

train = mutate(train, LoanAmount_log = log(LoanAmount), TotalIncome = ApplicantIncome + CoapplicantIncome,TotalIncome_log =log(TotalIncome))

apply(train, 2, pMiss) Loan_ID Gender Married Dependents Education

0 0 0 0 0

Self_Employed ApplicantIncome CoapplicantIncome LoanAmount Loan_Amount_Term

0 0 0 0 0

1.4 建立预测模型

在建立预测模型方面,分布建立logistic回归、决策树、随机森林并加以比较和改善。从代码编辑上看,python通过sklearn库构建预测模型函数,实现建立模型的打包处理,比R 分别调用不同的包进行模型模拟有更大的优势,值得学习和借鉴。

1.4.1 python

#转变所有的分类变量为数值变量

from sklearn.preprocessing import LabelEncoder

var_mod = ['Gender','Married','Dependents','Education','Self_Employed','Property_Area','Loan_Status']le = LabelEncoder()for i in var_mod:

df[i] = le.fit_transform(df[i])df.dtypesLoan_ID object

Gender int64

Married int64

Dependents int64

Education int64

Self_Employed int64

ApplicantIncome int64

CoapplicantIncome float64

LoanAmount float64

Loan_Amount_Term float64

Credit_History float64

Property_Area int64

Loan_Status int64

LoanAmount_log float64

TotalIncome float64

TotalIncome_log float64

dtype: object#载入sklearn库,选择相应的操作。

from sklearn.cross_validation import KFold #For K-fold cross validationfrom sklearn.ensemble import RandomForestClassifier

from sklearn.tree import DecisionTreeClassifier, export_graphviz

from sklearn import metrics#Generic function for making a classification model and accessing performance:def classification_model(model, data, predictors, outcome):

#拟合模型

model.fit(data[predictors],data[outcome])

#在训练集上预测模型

predictions = model.predict(data[predictors])

#打印模型准确性

accuracy = metrics.accuracy_score(predictions,data[outcome])

print "Accuracy : %s" % "{0:.3%}".format(accuracy)

#完成5折交叉验证

kf = KFold(data.shape[0], n_folds=5)

error = []

for train, test in kf:

train_predictors = (data[predictors].iloc[train,:])

train_target = data[outcome].iloc[train]

model.fit(train_predictors, train_target) #拟合模型

error.append(model.score(data[predictors].iloc[test,:], data[outcome].iloc[test]))

print "Cross-Validation Score : %s" % "{0:.3%}".format(np.mean(error))

#模型最终拟合

model.fit(data[predictors],data[outcome])1.4.2 R

library(rpart)

library(e1071)

library(rpart.plot)

library(caret)

library(Metrics)test <- read.csv("C:/Users/HP/Desktop/test.csv")1.5 Logistic

1.5.1 python

outcome_var = 'Loan_Status'model = LogisticRegression()predictor_var = ['Credit_History']classification_model(model, df,predictor_var,outcome_var)Accuracy : 80.945%

Cross-Validation Score : 80.946%1.5.2 R

#设置控制参数

fitControl <- trainControl(method = "cv", number = 5)

#拟合模型

logistic_model <- train(Loan_Status ~., data= train, method = "glmnet", trControl = fitControl, family="binormal")

print(logistic_model)#选择最优模型logistic_model <- train(Loan_Status ~., data= train, method = "glmnet", trControl = fitControl, family="binormal")

#模型预测logistic_predict <- predict(logistic_model, newdata= test,type = "vector")#模型评价

confusionMatrix(train$Loan_Status, logistic_model)1.6 决策树

1.6.1 python

model = DecisionTreeClassifier()predictor_var = ['Credit_History','Gender','Married','Education']classification_model(model, df,predictor_var,outcome_var)Accuracy : 80.945%

Cross-Validation Score : 80.946%1.6.2 R

#设置控制参数

fitControl <- trainControl(method = "cv", number = 5)cartGrid <- expand.grid(.cp=(1:50)*0.01)

#拟合模型

tree_model <- train(Loan_Status ~Credit_History+Gender+Married+Education, data= train, method = "rpart", trControl = fitControl, tuneGrid = cartGrid)

print(tree_model)#选择最优决策树模型main_tree <- rpart(Loan_Status ~., data= train, control = rpart.control(cp=0.36))#绘制决策树prp(main_tree)#模型预测pre_score <- predict(main_tree,type = "vector")#模型评价xtabs(~ pre_score + train$Loan_Status)1.7 随机森林

1.7.1 python

#随机森林model = RandomForestClassifier(n_estimators=100)predictor_var = ['Gender', 'Married', 'Dependents', 'Education',

'Self_Employed', 'Loan_Amount_Term', 'Credit_History', 'Property_Area']classification_model(model, df,predictor_var,outcome_var)Accuracy : 87.296%

Cross-Validation Score : 76.549%#变量重要性得分

featimp = pd.Series(model.feature_importances_, index=predictor_var).sort_values(ascending=False)

print featimpCredit_History 0.427036

Dependents 0.142901

Property_Area 0.102788

Loan_Amount_Term 0.100776

Self_Employed 0.077128

Gender 0.055985

Education 0.048056

Married 0.045331

dtype: float64model = RandomForestClassifier(n_estimators=25, min_samples_split=25, max_depth=7, max_features=1)

predictor_var = ['Credit_History','Dependents','Property_Area']classification_model(model, df,predictor_var,outcome_var)Accuracy : 80.945%

Cross-Validation Score : 80.458%1.7.2 R

library(randomForest)#设置参数

control <- trainControl(method = "cv", number = 5)

#随机森林

rf_model <- train(Loan_Status ~Credit_History+Dependents+Property_Area, data= train, method = "parRF",

trControl= control, prox = TRUE, allowParallel= TRUE)print(rf_model)#选择最优决策树

forest_model <- randomForest(Loan_Status ~Credit_History+Dependents+Property_Area, data= train,

mtry = 15, ntree = 1000)print(forest_model)#查看变量重要性排序

varImplot(forest_model)#模型预测

main_predict <- predict(forest_model, newdata= test,type = "vector")#模型评价

confusionMatrix(train$Loan_Status, main_predict)

写在文后(此处有雷):

由于在jupyter中跑R,有些模型会出现一些莫名的问题和错误,因此R有些代码在jupyter中并不能跑成功。本人也在抓紧找出原因并解决,如出现错误,请各位大侠指正。感激不尽!

”乐享数据“个人公众号,不代表任何团体利益,亦无任何商业目的。任何形式的转载、演绎必须经过公众号联系原作者获得授权,保留一切权力。欢迎关注“乐享数据”。